Understanding the Process and Benefits of Obtaining a Bank License for Sale

In today's dynamic financial landscape, the notion of acquiring a bank license for sale has piqued the interest of numerous entrepreneurs and investors. This article aims to explore the multifaceted benefits, processes, and implications of owning a bank license with a special focus on how it empowers individuals and businesses to thrive. With the right knowledge and preparation, understanding the intricacies of bank licenses can significantly enhance your business strategy.

The Financial Landscape Today

The financial world has been undergoing significant transformations, especially with the rise of digital banking and fintech solutions. Traditional banks are challenged by modern financial institutions that offer streamlined services, appealing user interfaces, and competitive rates. This evolving landscape provides a unique opportunity for those looking to obtain a bank license for sale. Here are some factors to consider:

- The Rise of Digital Banking: Digital banks are becoming increasingly prevalent, providing services conveniently accessible through apps and websites.

- Fintech Innovations: Startups in the fintech sector are offering niche services that cater to specific market segments.

- Regulatory Changes: As regulations evolve, the barriers to entry in the banking sector may shift, creating new opportunities for aspiring bank owners.

What is a Bank License?

A bank license is a legal authorization issued by a regulatory authority that permits an entity to engage in banking activities, such as accepting deposits, making loans, and providing financial services. These licenses ensure that institutions comply with local and international banking regulations, thus maintaining financial stability and consumer trust.

When considering a bank license for sale, it is crucial to understand the specific types of licenses available:

- Commercial Bank License: Allows the institution to offer a full range of banking services.

- Investment Bank License: Focuses on underwriting securities, facilitating mergers and acquisitions, and offering advisory services.

- Savings and Loan License: Designed for institutions primarily focused on accepting deposits and facilitating home loans.

- Offshore Banking License: Provides the ability to operate internationally, often with advantageous tax conditions.

The Process of Acquiring a Bank License

The journey to acquiring a bank license, particularly through the bank license for sale option, involves careful planning and adherence to regulatory standards. Below are the essential steps to facilitate this process:

1. Research and Planning

Before pursuing a bank license, performing extensive research on the market is vital. Additionally, consider the following:

- Identify your target market and customer needs.

- Analyze existing competition and their offerings.

- Assess the financial requirements associated with starting a bank.

2. Choosing the Right Type of License

Evaluate the different types of licenses and determine which aligns best with your business goals. Each type serves unique functions and caters to different market needs.

3. Compliance and Regulatory Obligations

Engage with legal experts who specialize in banking regulations to ensure compliance with local laws. This step includes:

- Preparing a detailed business plan that outlines your operational model and financial projections.

- Submitting applications and required documentation to regulatory authorities.

- Undergoing background checks and due diligence processes.

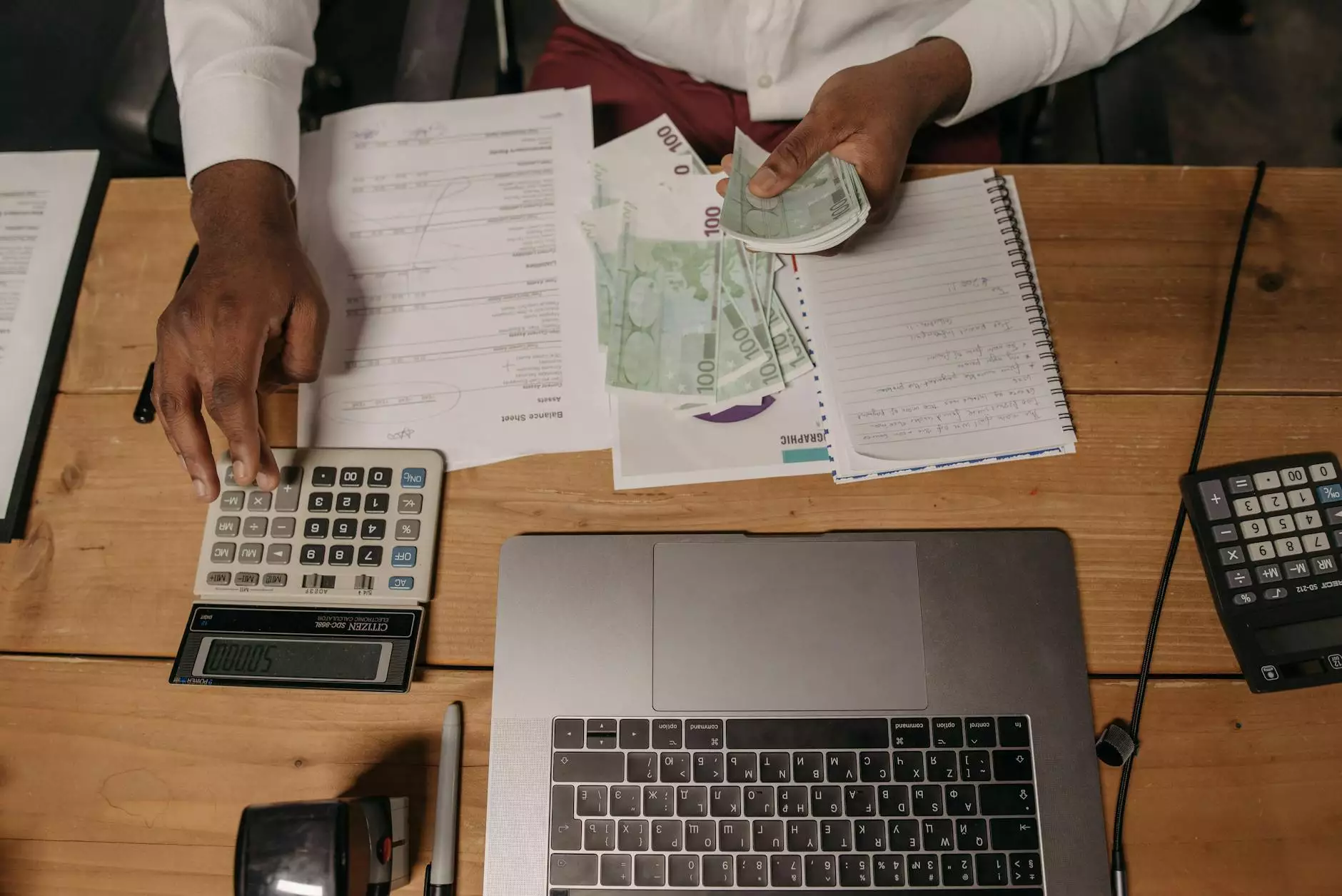

4. Securing Capital

Establish a solid financial foundation as banks are often required to maintain a certain level of capital reserves. This step may involve:

- Attracting investors or stakeholders.

- Exploring traditional financing options.

- Utilizing personal funds for initial setup costs.

5. Operational Setup

Once licensed, focus on establishing efficient operations, which include:

- Setting up IT infrastructure and compliance systems.

- Recruiting a qualified team with banking experience.

- Developing customer service protocols.

Advantages of Owning a Bank License

The benefits of holding a bank license extend beyond merely being able to accept deposits or give loans. Here are several compelling reasons to consider a bank license for sale:

1. Profit Potential

The banking industry is renowned for its lucrative opportunities. With proper management and innovative services, a licensed bank can generate substantial profits through:

- Interest on loans

- Fee-based services

- Investment products

2. Market Stability

Owning a bank can provide stability during economic fluctuations; banks can adapt their services based on market needs and consumer trends.

3. Consumer Trust

A licensed bank enhances your credibility and attracts a more extensive customer base. Consumers are typically more willing to trust institutions that are properly regulated and licensed.

4. Diverse Revenue Streams

A bank can diversify its income sources by offering various products, including:

- Personal and business loans

- Credit cards

- Wealth management services

5. Growth Opportunities

With a established bank license, opportunities for expansion grow significantly. This can involve:

- Branching out into new geographical markets

- Partnering with fintech companies for innovative solutions

- Expanding service offerings to cater to niche markets

Considerations and Challenges

Despite the many benefits, aspiring bank owners should also be aware of potential challenges associated with acquiring and running a bank:

- Regulatory Scrutiny: Banks are subject to stringent regulations, requiring continuous compliance and reporting.

- Capital Requirements: Starting a bank typically necessitates significant initial capital investment.

- Market Competition: The financial sector is highly competitive, and it takes strategic planning to differentiate your bank from others.

The Future of Banking and Licensing

With the ongoing evolution of technology and changing customer expectations, the future of banking is ripe with opportunities. The demand for agile, customer-centric banking solutions is growing, and obtaining a bank license for sale places you in a strategic position to capitalize on these trends.

As regulators adapt to changes in technology and consumer behavior, the banking landscape will continue to evolve. Staying informed about new regulations, customer needs, and technological advancements will be critical for success.

Conclusion

Acquiring a bank license for sale can be a significant step towards achieving your business goals in the complex financial sector. From the potential for high profitability to the establishment of consumer trust, the advantages are numerous. By understanding the necessary steps, the market landscape, and potential challenges, you can position yourself for sustainable success in the banking industry.

Take the first step in realizing your banking aspirations by exploring the opportunities available in the market today!

bank licence for sale