Unlocking Success with Leading Online Prop Trading Firms in Financial Services

In the rapidly evolving landscape of global finance, online prop trading firms have emerged as pivotal players driving innovation, profitability, and cutting-edge trading strategies. These firms have revolutionized traditional trading paradigms by leveraging advanced technology, comprehensive training programs, and flexible capital access, empowering traders and investors to achieve unprecedented success. In this comprehensive article, we delve into the intricate world of online prop trading firms, highlighting their role in transforming financial services, the benefits they offer, and how they can be a key component of modern trading portfolios.

What Are Online Prop Trading Firms?

Online prop trading firms are specialized financial institutions that provide traders with access to significant trading capital in exchange for a share of the profits generated. Unlike traditional brokerages that facilitate client trades, these firms operate on a proprietary trading model, meaning they trade with their own funds to generate profits. The primary objective of such firms is to identify, nurture, and profit from skilled traders who employ effective strategies across various financial instruments, including stocks, forex, commodities, and cryptocurrencies.

The Business Model of Online Prop Trading Firms

These firms have a unique operational framework that combines risk management, trader development, and technological innovation:

- Capital Allocation: Firms allocate substantial trading capital to selected traders based on their performance and risk management skills.

- Profit Sharing: Traders keep a percentage of the profits they generate, aligning incentives for success.

- Trader Evaluation: An essential part of their model involves rigorous testing, skill assessments, and simulated trading challenges to identify top talent.

- Risk Management: Firms employ strict risk controls, stop-loss protocols, and leverage limits to protect their capital and ensure sustainable growth.

- Technology Infrastructure: Advanced trading platforms, real-time analytics, and AI-driven algorithms optimize trading decisions and performance tracking.

Why Online Prop Trading Firms Are Transforming Financial Services

The rise of online prop trading firms has significantly impacted financial services by democratizing access to sophisticated trading environments and capital. Their innovative approach offers multiple advantages:

1. Democratization of Trading Opportunities

Traditionally, trading at high levels required significant personal capital, expertise, and access to institutional-grade infrastructure. Online prop trading firms create a level playing field by providing talented traders with the necessary capital, regardless of their personal wealth, fostering a more inclusive trading ecosystem.

2. Enhanced Market Liquidity and Efficiency

Prop firms contribute to increased liquidity across markets by actively participating via a variety of instruments and trading strategies. This not only stabilizes markets but also improves execution speeds and reduces spreads, benefiting all market participants.

3. Innovation Through Technology

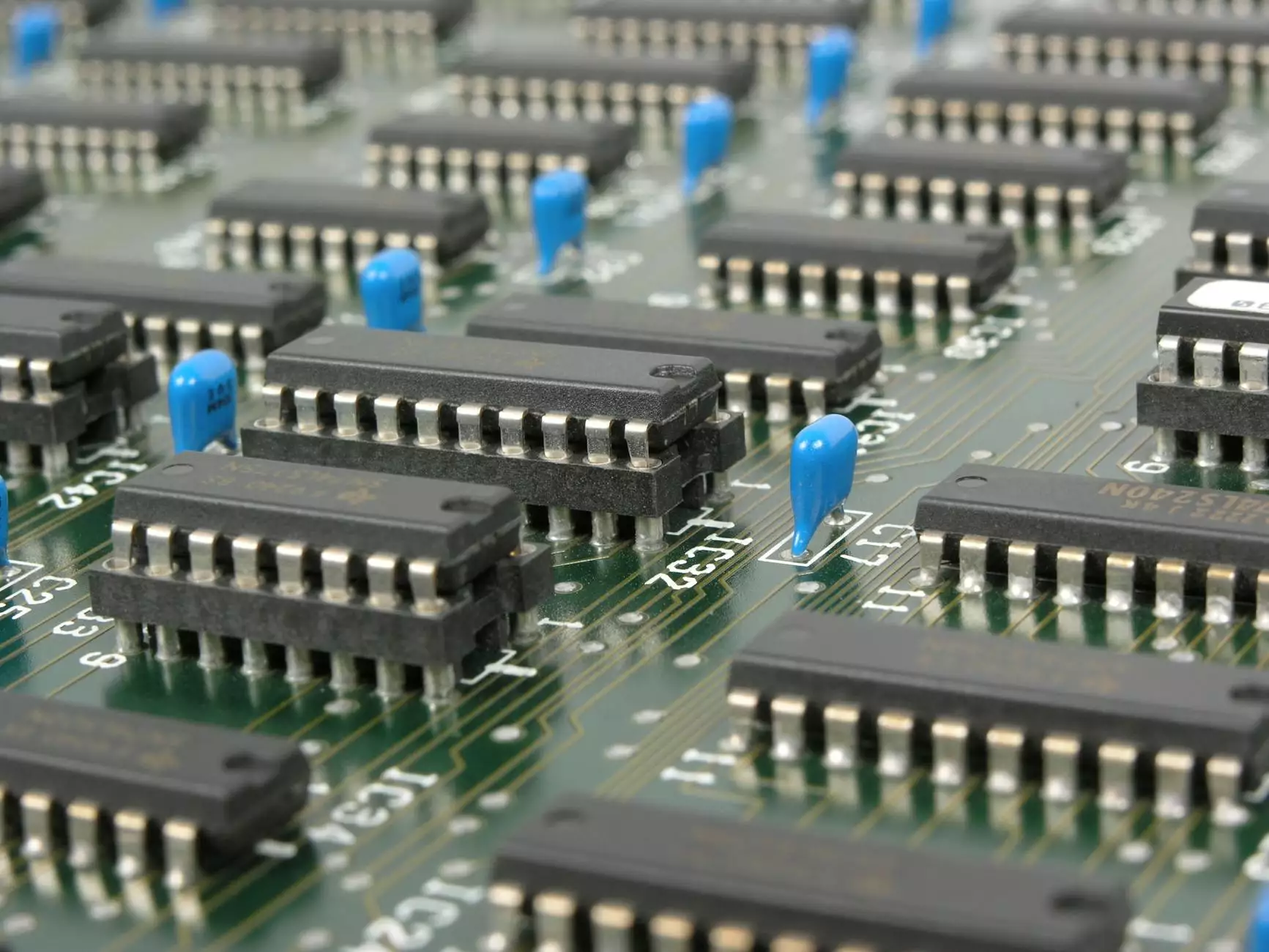

By investing heavily in state-of-the-art trading technology, online prop trading firms enable traders to access high-frequency trading, AI-based analytics, risk assessment tools, and automated trading systems—all designed to maximize profitability and minimize losses.

4. Creation of New Career Opportunities

These firms serve as training grounds for aspiring traders, offering mentorship and skill development programs. Successful traders can advance their careers or even launch their own trading ventures, further stimulating innovation within the industry.

Key Benefits of Partnering with Online Prop Trading Firms

Choosing to work with online prop trading firms offers several strategic advantages:

- Access to Significant Capital: Traders can leverage the firm's capital to scale their trading operations beyond personal resources.

- Risk Management Support: Professional risk protocols reduce the likelihood of catastrophic losses.

- Training and Mentorship: Many firms provide comprehensive education to help traders refine their skills.

- Flexible Trading Strategies: Traders can employ various strategies, including day trading, swing trading, and algorithmic trading.

- Technology and Infrastructure: Access to cutting-edge platforms accelerates decision-making and execution quality.

- Potential for Lucrative Profits: Successful traders can earn significant returns proportionate to their skill and risk appetite.

Choosing the Right Online Prop Trading Firm

Not all prop trading firms are created equal. When evaluating potential partners, consider these critical factors:

1. Reputation and Credibility

Research the firm's history, regulatory compliance, and client testimonials to ensure legitimacy and reliability.

2. Profit Sharing and Fee Structures

Understand the profit split ratios, evaluation fees, and any other costs involved to assess overall profitability.

3. Support and Training Programs

Look for firms that invest in their traders' development through mentorship, webinars, and resource access.

4. Technology and Trading Platforms

Prioritize firms that provide access to robust, user-friendly, and technologically advanced trading systems.

5. Risk Management Protocols

Ensure the firm employs strict risk controls to protect both their capital and the trader’s interests.

The Future of Online Prop Trading Firms in Financial Services

The landscape of online prop trading firms continues to evolve rapidly, driven by technological advancements and changing market dynamics. The integration of artificial intelligence, blockchain, and machine learning is opening new horizons for profitable trading strategies and operational transparency.

Furthermore, regulatory developments are fostering greater accountability and investor protection, enabling firms to build more sustainable and trustworthy environments for traders and investors alike. As financial markets grow more complex, online prop trading firms are positioned to remain at the forefront of innovation, offering new opportunities for talented traders and investors worldwide.

Conclusion

In summary, online prop trading firms are revolutionizing the financial services industry by merging technological innovation, trader empowerment, and strategic risk management. They offer a unique avenue for skilled traders to access substantial capital, optimize their trading strategies, and generate significant profits while minimizing risks. For investors and traders seeking to capitalize on emerging market opportunities, partnering with a reputable prop trading firm like propaccount.com can be a transformative decision.

The future of proprietary trading is bright, characterized by increased democratization, technological advancements, and improved market efficiency. Embracing this evolution can unlock new potentials for traders of all backgrounds—making online prop trading firms an indispensable component of modern financial strategies.

As the industry continues to grow and innovate, staying informed and choosing the right partner will be essential for those aiming to thrive in this competitive environment. The synergy between talented traders and innovative prop firms holds tremendous promise for shaping the future of financial trading on a global scale.